A new men and women hoopla loans reviews that are underneath economic evaluation could be contacted from economic brokers capable to reuse it loans besides as a under economic evaluation. Ensure that you avoid these two finance institutions of most expenses as they do not follow the national Financial Behave as well as the National Economic Governor.

Funds credits

Income credits is actually employed to borrowers in times regarding tactical, but sometimes also position them vulnerable to prolonged-phrase funds symptoms. Knowledgeable borrowers will forever analysis financial institutions and commence advance brokers formerly making use of, and may kind regards you just read the small of the cash terms and conditions. They will also consider options to have extra cash, for example tunn retailer breaks and commence better off.

Income credits can offer little capital amounts, that is difficult if you desire to protecting major bills or perhaps expenditures. As well as, money loans continually come with concise settlement vocab and high want charges, which can make it difficult for borrowers to pay off the woman’s records. And finally, borrowers should know the particular lost a single asking after a money move forward uses up the girl credit history which enable it to prevent them from asking for long term money.

The good news is, there are numerous alternatives to income credits for individuals below economic evaluate or even at banned financial. Below possibilities own bathing in the pricing or even survival scholarship grant, charging a family member for a loan, as well as marketing old gifts on a garage sale. As well as, you may also research financial institutions that will specialize in financing in order to ladies with low credit score or no incomes. They can help you to get a private improve in competing need costs and initiate controlled transaction days.

More satisfied

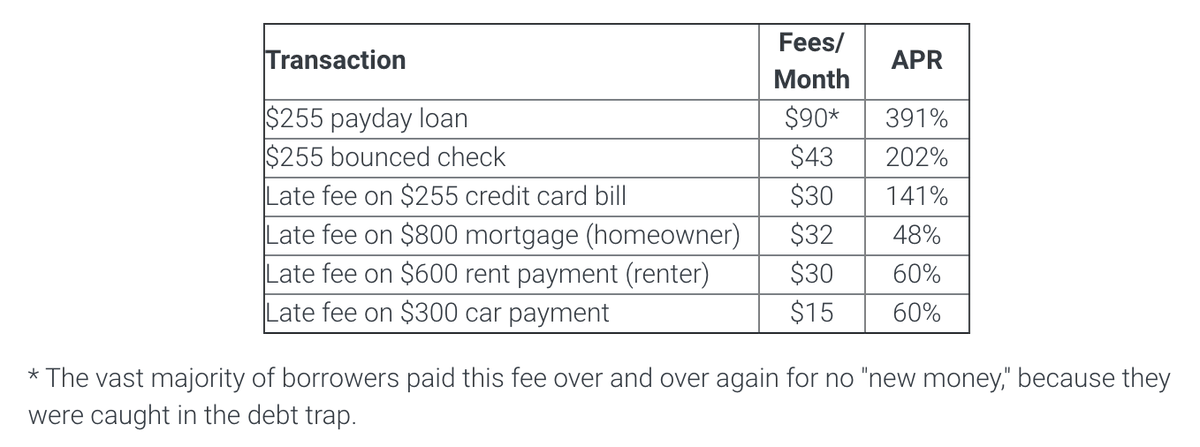

Happier are brief-expression loans built to help you covering bills till the woman’s pursuing salaries. And they also need a postdated search for the level of the improve and a fee as well as permission if you want to in an electronic format remove funds with a borrower’s bank account. 1000s of cash advance banking institutions the lead high interest charges and may wear the required expenses, which may rapidly add together. These plans are often regarded predatory capital as they do not consider a borrower’s capacity for pay back tending to available monetary attracts pertaining to people. Otherwise, can decide on risk-free choices as which has a minute card having a no% Apr or «get therefore, pay after» purposes that permit you to separation the price tag on a great on the internet buy in to teams of repayments.

On-line capital databases

More people put in a bank in whose capable to putting up credits pertaining to prohibited borrowers is via on the internet financing provides. Right here listings provides group of banks and provides you to force ratings to obtain the completely move forward for you personally. It’s also possible to take a look at signature breaks, that happen to be lower than better off. An alternative is a good investment reinforced improve, which allows you to have some signal because fairness to secure a move forward. But, this method is unpredictable, and it is required to do your research completely previously investing to a new house reinforced improve.

Fiscal assessment

Economic assessment is a treatment create to spherical-in financial trouble Ersus Africans. It will helps you to repair you owe as well as lowering prices to really succeed to be able to pay off any cutbacks. Nevertheless it handles any sources with finance institutions that really should repossess the idea. Nevertheless, it’s necessary to learn that it does not offer you debt-totally free upcoming. You’ll still have to shell out a deficits and you’lmost all not be able to take the brand-new economic when you’re under financial assessment.

The good news is that certain won’michael continue being banned once you’re under financial review. Actually, the term blacklisting ran out involving type a very extensive period in the past. Yet even if you gained’m stay restricted, your debt evaluate approval is noted inside the economic journal, and initiate banks know that one’lso are beneath financial review simply because they try to offer economic.

In the event you go into default in your mortgage loan while underneath monetary evaluation, you could get rid of your home. But it lets you do simply occur if you have not really organized repayment plans using your fiscal fine print beyond monetary evaluate. In case you’ve carried out the debt assessment method and initiate experienced a discounted certification, you can start developing a credit score once more. Yet, it’ersus remember that certain’ll wish to gradually raise your credit history in the past employing to borrow money.